Unlocking Financial Success: The Significance of Establishing Financial Goals

In the hustle and bustle of daily life, it’s easy to overlook the significance of setting financial goals. Yet, this simple practice can be transformative, paving the way for a secure financial future and fulfilling life. Let’s delve into the reasons why setting financial goals is crucial and how it can shape your journey towards financial freedom and prosperity.

1. Clarity and Focus:

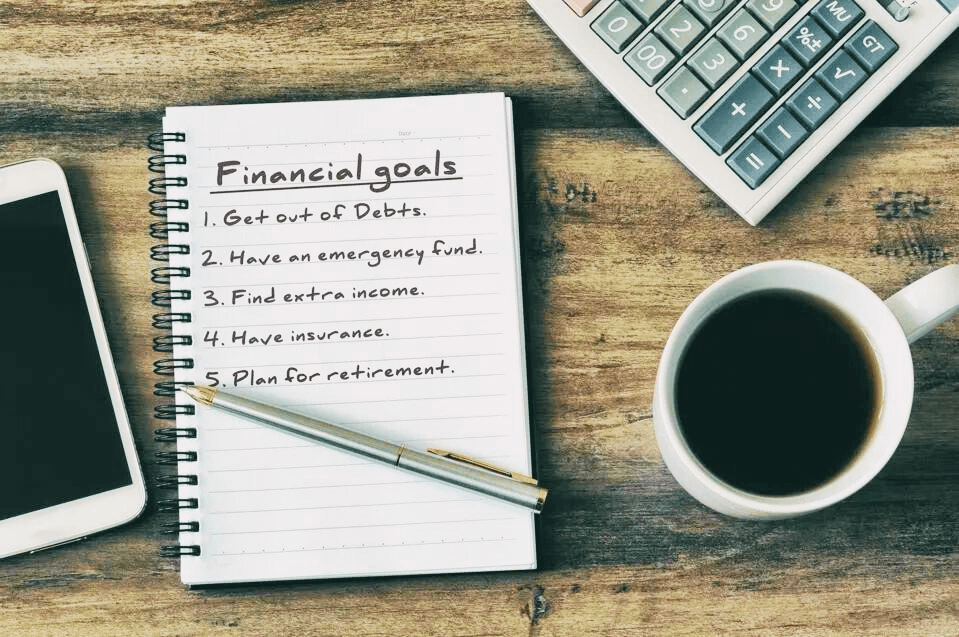

Setting financial goals offers a clear vision of what you want to achieve. Whether it’s buying a home, saving for retirement, or starting a business, having defined objectives helps prioritize spending and focus on what truly matters. By identifying your aspirations, you can channel your resources towards fulfilling them, steering clear of distractions and unnecessary expenses.

2. Roadmap and Planning:

Specific financial goals act as a roadmap, guiding your financial decisions and actions. With a well-defined plan in place, you’re more likely to stay on track and make progress towards your objectives. Whether it’s creating a budget, investing in assets, or paying off debts, having a structured approach enhances your financial discipline and ensures that you’re moving in the right direction.

3. Alignment with Values:

Meaningful financial goals resonate with your values and priorities, reflecting what truly matters to you. Whether it’s supporting your family, giving back to the community, or pursuing your passions, aligning your goals with your values instills a sense of purpose and fulfillment. Moreover, it sets you on a path towards financial freedom and a debt-free life, aligning your actions with your aspirations.

4. Confidence and Stress Reduction:

Achieving financial goals boosts confidence in your money management abilities. By making progress towards your objectives, you gain a sense of accomplishment and empowerment, knowing that you’re taking charge of your financial future. Additionally, having clear goals reduces money-related stress, as you’re less likely to be overwhelmed by uncertainty and financial challenges.

5. Positive Outcomes:

Defined financial goals increase the likelihood of positive financial outcomes. Whether it’s building wealth, achieving financial independence, or enjoying a comfortable retirement, having clear objectives provides a roadmap for success. By setting measurable targets and tracking your progress, you can celebrate your achievements and adjust your strategies as needed to stay on course.

6. Accountability and Motivation:

Financial goals create built-in accountability, holding you accountable for your financial decisions and actions. Whether it’s sticking to a budget, saving regularly, or avoiding impulse purchases, having clear goals reinforces discipline and accountability. Moreover, goals serve as a source of motivation, fueling your commitment to financial success and inspiring you to persevere in the face of challenges.

7. Improved Money Mindset:

Setting financial goals shapes a proactive money mindset, fostering a positive relationship with money and abundance. Instead of viewing finances as a source of stress or limitation, you approach them with confidence and optimism, seeing them as a tool for achieving your dreams. By adopting a growth-oriented mindset, you’re more open to opportunities and better equipped to overcome obstacles on your financial journey.

8. Hope and Confidence in the Future:

Financial goals inspire hope and confidence in your ability to achieve financial security and prosperity. By envisioning a brighter future and taking concrete steps towards it, you cultivate a sense of optimism and resilience. Whether it’s overcoming setbacks, navigating economic challenges, or pursuing new opportunities, having clear goals provides a sense of direction and purpose.

Conclusion:

In conclusion, setting financial goals is not just about numbers; it’s about creating a roadmap to the life you envision. By defining your aspirations, aligning them with your values, and taking consistent action, you can turn your dreams into reality. Remember, every step you take towards your financial goals brings you closer to a future of abundance and fulfillment. So, dare to dream big, set clear objectives, and embark on your journey towards financial success with confidence and determination.